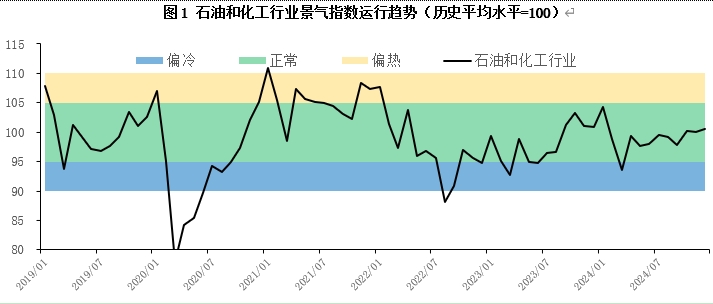

In December, the prosperity index of the petroleum and chemical industry rebounded, hoping for improved efficiency

1、 Overview of the Prosperity of the Petroleum and Chemical Industry

In December 2024, although production and inventory turnover in the petrochemical industry slowed down, production costs decreased, and business revenue increased year-on-year. Profit recovery was evident, leading to a slight increase in the prosperity index of the petroleum and chemical industry to 100.58, a new high since March 2024, indicating that China’s petroleum and chemical industry is currently showing a recovery trend. From the perspective of sub indices, the sustained low crude oil prices in the early stage gradually spread to downstream manufacturing links, and the profit margins of the chemical raw materials and chemical products manufacturing industry, as well as the rubber, plastic, and other polymer products manufacturing industry, were restored, driving a slight increase in the prosperity index. However, downstream industries still face the dilemma of weak terminal demand, with no significant improvement in production and a temporary slowdown in crude oil demand. At the same time, before Trump took office, domestic companies accelerated their crude oil imports, resulting in a significant decline in inventory turnover in the oil and gas extraction industry, and the economic index declined for the eighth consecutive month. For the fuel processing industry, due to the absence of extreme cold weather, there is still an increase in fuel demand for transportation, and the prosperity index has slightly increased.

According to data from the National Bureau of Statistics, the Purchasing Managers’ Index (PMI) for the manufacturing industry in December fell 0.1 percentage points month on month to 50.1%. Although the manufacturing industry as a whole is still in the expansion zone, the expansion speed has slowed down, which indirectly reflects the weak production heat of the current chemical manufacturing industry. From financial data, it can be seen that the financing demand on the enterprise side has weakened, and physical enterprises are still facing operational pressure, with weak financing willingness. Under a moderately loose monetary policy and a more proactive fiscal policy, terminal demand will recover and business confidence will be effectively boosted, which will provide support for the economic index.

On the international front, although the extension of the OPEC+production reduction agreement has brought certain benefits to international oil prices, with the Federal Reserve cutting interest rates by another 25 basis points in December, the market expects that the Fed’s interest rate cuts will slow down in the future. The continued strength of the US dollar has suppressed the rise in crude oil prices for most of December, putting some pressure on the production and operation of the petroleum and chemical industries.

2、 Hotspot analysis and future prospects

1. More proactive fiscal policy and sustained boost in market confidence

In December 2024, the Political Bureau of the Communist Party of China Central Committee and the Central Economic Work Conference were held successively. The statement of the Central Political Bureau meeting was upgraded from “increasing the intensity of countercyclical regulation” in September to “strengthening unconventional countercyclical regulation”; The Central Economic Work Conference proposed that the monetary policy should be changed from stable for 14 years to moderately loose, and the fiscal policy should be changed from active to more active. All of these fully demonstrate the country’s determination to promote economic recovery and improvement, and will continue to inject vitality into the development of the petroleum and chemical industries. Specifically, on the demand side, real estate policies have been continuously introduced since mid-2024, and there are signs of stabilization and recovery in the real estate market; With the support of the trade in policy, the development of industries such as automobiles and home appliances continues to improve. Future macro policies may be more proactive, and the demand for related chemical products is expected to further increase. On the supply side, the chemical expansion cycle of the petroleum and chemical industry, which began in 2021, is nearing its end. The year-on-year growth rates of capital investment and ongoing projects in the chemical industry have both shown a downward turning point. The petroleum and chemical industry may adjust its existing capacity structure through a new round of supply side reforms, which will reduce supply pressure and improve the operating conditions of enterprises.

2. Crude oil prices continue to fluctuate at low levels, and challenges still exist in the petroleum and chemical industries

In the foreseeable future, international crude oil prices are unlikely to rise significantly, which may weaken the support for the petroleum and chemical industries. The production and operation of the petroleum and chemical industries will face challenges. On December 31st, the closing price of WTI crude oil was $71.87 per barrel, up 5.43% from the beginning of the month; The closing price of Brent crude oil was $74.83 per barrel, up 4.03% from the beginning of the month. International oil prices have been fluctuating for most of December, gradually forming an upward trend towards the end of the month.

From the supply side, OPEC+announced at its meeting on December 5th that it would extend the voluntary production reduction agreement of 2.2 million barrels per day for another three months and adjust the originally planned 12-month resumption period to 18 months; The formal production reduction of 2 million barrels per day and the additional production reduction plan of 1.66 million barrels per day will be extended until the end of 2026; The compensation period for countries with excess production will be extended until the end of June 2026. The series of statements by OPEC+are in line with market expectations, easing concerns about oversupply in the crude oil market and providing some support for crude oil prices.

From the demand side, even though US commercial crude oil inventories have recently fallen to a low level and China’s crude oil imports have increased, OPEC, the International Energy Agency (IEA), and the US Energy Information Administration (EIA) all lowered their global crude oil demand forecasts for 2024 and 2025 in early December. Market concerns about the worsening supply-demand imbalance in the future still exist, which to some extent has suppressed the rise in crude oil prices.

The Federal Reserve cut interest rates by another 25 basis points at its December meeting, bringing the total rate cut since September to 100 basis points. With the Federal Reserve’s further interest rate cuts, market expectations for the number and magnitude of rate cuts in 2025 have decreased, and the US dollar is gradually strengthening, putting pressure on crude oil prices. In addition, there are signs of a rebound in US inflation, and market expectations have increased for Trump to suppress inflation by suppressing oil prices after taking office.

3. Outlook for the prosperity of the petroleum and chemical industry

In December, although the production heat and inventory turnover rate of the petroleum and chemical industry slowed down, the decrease in production costs drove the industry’s profit margin to rebound, becoming the main driving force for the slight decline in the prosperity index of the petroleum and chemical industry. At the end of January 2025, it is the Spring Festival holiday, and some downstream production enterprises may purchase in advance. However, the room for profit margin recovery is limited, and most downstream enterprises will adjust their production pace, resulting in a slowdown in production heat. The prosperity index of the petroleum and chemical industry may decline month on month.